What is AASB S2? Climate reporting for Australian organisations

What this guide covers

Climate reporting is now a reality for many Australian organisations

What is AASB S2?

kandu explainer

Think of AASB S2 as creating a common language for climate disclosure - like financial reporting standards, but for climate information. This consistency makes it easier for investors, stakeholders, future people hired, and customers to understand and compare how different organisations manage climate risks and opportunities.

The four pillars: How AASB S2 structures climate disclosure

1. Governance

This is common across most standards (like the ISO standards suite). It is about leadership awareness. Boards and management teams need to show they're aware and across how climate impacts affect or may affect the organisation, not just ticking boxes. This means explaining who makes the climate decisions, how information flows up to leadership, and how climate considerations influence what the organisation does.2. Strategy

This is where organisations explore and analyse how climate change may impact the organisation. It's about looking ahead - sometimes way ahead - and thinking through what physical risks (floods, heat waves, droughts) and transition risks (new policies, shifting markets, technology changes) might mean for business models and bottom lines.3. Risk management

Here's where the rubber meets the road on managing climate risks. It's about showing how climate risks get identified, assessed, and managed alongside all the other risks organisations deal with every day. The key is integration, treating climate risk as part of everyday business risk, not a separate issue.4. Metrics and targets

This covers the metrics organisations use to assess and manage climate risks and opportunities - greenhouse gas emissions (starting with Scope 1 and Scope 2, with Scope 3 coming later), climate-related targets, performance indicators, and progress tracking. It's about having meaningful measures that show how you are tracking and whether strategies are working.Who needs to comply? Understanding the rollout

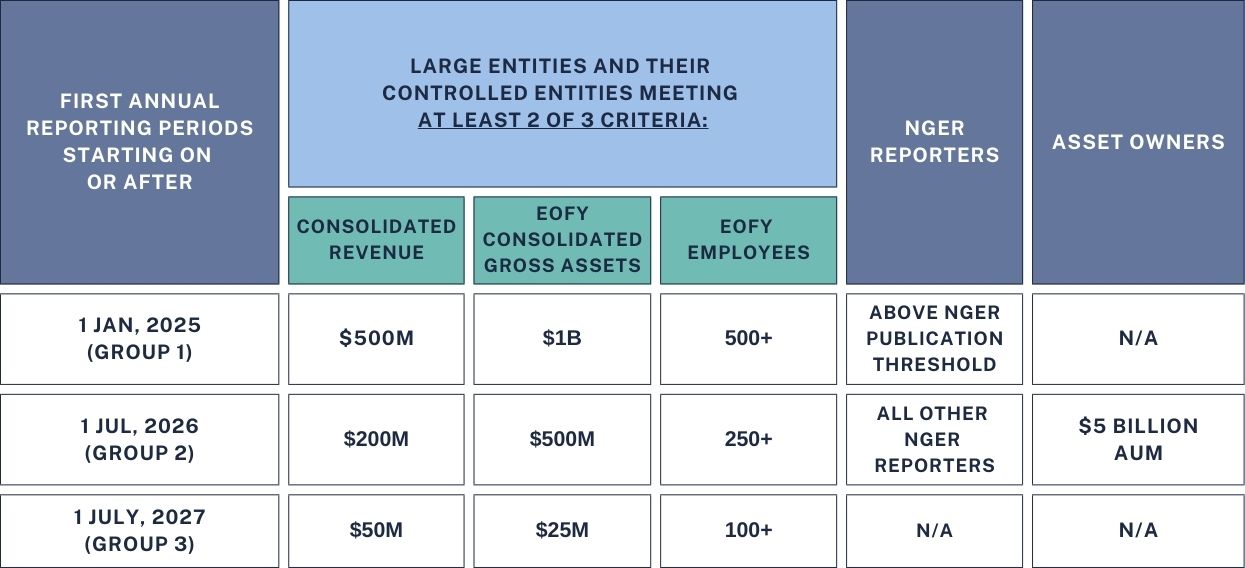

AASB S2 compliance timeline and organisation size thresholds

The timeline is designed to give organisations breathing room to build capabilities, and deal with reporting complexities in future years.

Important note: Group 3 entities with non-material climate risks can provide a simplified Director's declaration rather than full climate disclosure.

Check ASIC guidance[3] for specific exceptions and implementation details.

What is materiality? When climate risks become financially significant

kandu explainer

Climate risk is like water filling a bathtub. Physical risks (floods, droughts, rising sea levels) and transition risks (policy changes, new technology, shifting markets, reputation impacts) are the taps filling the tub. Organisational resilience strategies act as the drain, managing and mitigating these risks. Materiality assessment helps identify which taps could overflow the bathtub, which taps allow flow management and by how much.

💡 Key takeaway

Materiality assessment isn't academic - it's about identifying which climate risks and opportunities could impact the bottom line. This practical focus can help teams decide where to focus their time, energy, and resources.

Integrating AASB S2: Understanding the landscape

Building foundations: The graduated approach

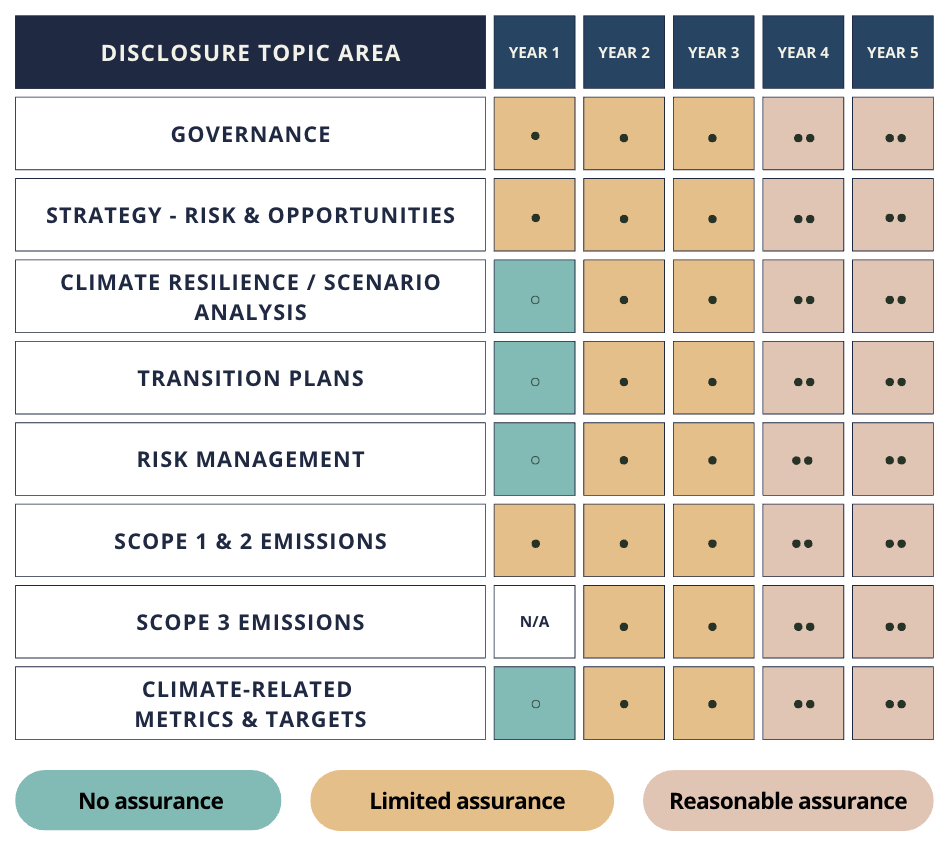

The phased approach acknowledges that building these capabilities takes time and coordination across multiple business functions. Establishing strong foundations early creates a platform for more sophisticated disclosures as your capabilities mature. What starts as governance and emissions tracking evolves into scenario analysis, transition planning, and forward-looking risk assessment. A more confident, future-ready response to change.

AASB S2 disclosure requirements and assurance timeline across five years

Beyond compliance: The strategic value of AASB S2

- Improved risk management comes from systematic assessment of climate threats that could impact operations, supply chains, or markets.

- Enhanced investor confidence flows from transparent disclosure that helps stakeholders understand how organisations are preparing for climate-related changes.

- Better decision-making happens as climate considerations become embedded into capital allocation and strategic planning processes. It's about making climate factors part of normal business thinking, not something separate.

- Competitive advantage emerges as customers, partners, and talented people increasingly prioritise working with climate-responsible organisations.

Want practical sustainability insights delivered to your inbox? Subscribe to our updates

Working through implementation challenges

Data gaps in emissions measurement

Start with available data while building more comprehensive systems. The graduated approach gives organisations time to develop measurement capabilities in Scope 1 and Scope 2, while laying the foundations for more complex Scope 3 emissions.Scenario analysis complexity

Beginning with qualitative scenario analysis using publicly available scenarios allows organisations to build understanding before developing quantitative approaches. The standard recognises this progression by not requiring scenario analysis in the first year.Resource constraints

The phased implementation timeline allows organisations to focus on governance and strategy elements first - these often require coordination more than technical resources.Embedding with financial reporting

Cross-functional collaboration between sustainability, finance, and risk management teams supports alignment between climate and financial disclosures. Most implementation challenges have practical responses. The standard's graduated approach acknowledges that building climate reporting capabilities takes time, collaboration, and thoughtful effort.Did you know?

In Australia, the mandatory sustainability report component is part of the Annual Reporting suite, making the Finance team a central stakeholder in this process.

Looking after sustainability reporting and not in the finance team = time to become work besties.

The supplier opportunity

Large Australian companies are increasingly prioritising suppliers with sustainability capabilities, with some directing significant procurement spend toward sustainable partners.

Understanding what these buyers want and how to position capabilities effectively requires insight into their specific requirements and decision-making processes.

Moving forward with AASB S2

"This is where structured guidance and collaborative problem-solving make the difference between compliance and resilience."

Like the sound of integrating climate reporting into existing processes? Let's chat.

- • What: Mandatory climate reporting for eligible Australian organisations

- • When: Phased rollout from January 2025 to July 2027

- • Structure: Four pillars - Governance, Strategy, Risk Management, Metrics & Targets

- • Year 1 focus: Governance, strategy basics, Scope 1 & 2 emissions

- • Key concept: Materiality - focus on climate impacts that affect financial outcomes

- • Strategic benefit: Stronger risk management, greater investor confidence, and long-term resilience.

Supporting documents

Related sustainability topics

- Scope 1, 2, 3 emissions for businesses

Learn about carbon accounting and emissions categories

- What is Scope 3 emissions? Value chain greenhouse gas emissions explained

Explore value chain greenhouse gas emissions

- What is Scope 1 emissions? Direct greenhouse gas emissions explained

Understand direct greenhouse gas emissions from your operations

Need help with sustainability reporting?

We help make climate disclosure clear, actionable, and strategic: explore how we can help

- Subscribe to our insights for regular updates on Australian sustainability reporting standards.

- Download your FREE AASB S2 quick gap analysis to identify exactly where your organisation stands on climate disclosure compliance.

- Let's chat about your AASB S2 journey - we provide tailored guidance, workshops, and strategic implementation support.